Why Buy Silver?

"The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, assistance to foreign lands should be curtailed lest Rome become bankrupt, the mobs should be forced to work and not depend on government for subsistence." - Marcus Tullius Cicero of Ancient Rome (January 3, 106 BC - December 7, 43 BC)There are many articles out there giving advice to people about how to invest their money. What works for one person may not work for another person. There are many reasons to invest. First of all, one may be simply trying to hold on to some value and not be concerned about making a return on their investment. Precious metals such as silver, gold, platinum, and palladium (both coin and bullion form) provide a resource to invest in, a hedge against inflation, a recognized object of value to barter, and something physical to hold for possible future value appreciation. In particular, buying silver coins and silver bullion is an ideal way to satisfy these needs and concerns.

Why not Gold? Read this article about reasons why buying silver (junk silver, silver rounds, and bullion) makes more sense for most people than buying gold bullion and gold coins.

"Why Not Gold?"

Another reason to put your money into hard assets can be found by reading the daily news about the government deficit. The national debt is rising at an unprecedented rate. What the government can't borrow, it is printing. Money is being created by the Federal Reserve in both paper currency and electronic money. Over time, this will eat away at the recognized value of paper fiat currency. This link gives stunning statistics showing our ballooning federal deficit (US Debt Clock) as well as how fast money is being created.

"US Debt Clock"

Glenn Beck so eloquently explains our current money creation crisis in this video. With money being printed and electronically created so fast, the need for buying precious metal hard assets such as junk silver is urgent.

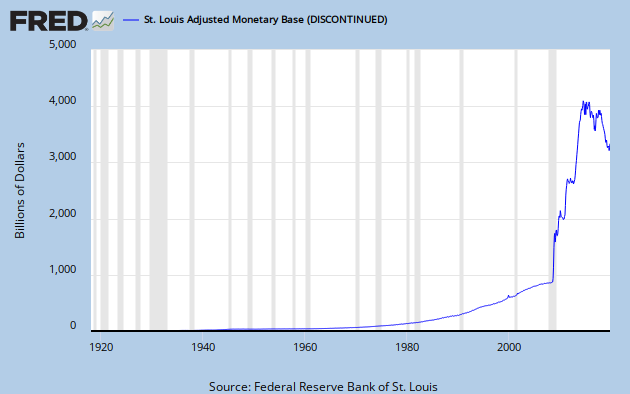

This chart is by the St. Louis Fed. It shows a similar situation of how our money supply is exponentially increasing.

Graph: St. Louis Adjusted Monetary Base (AMBNS)

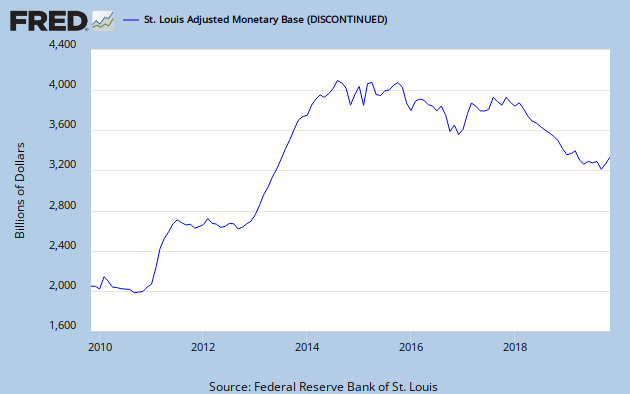

Graph: St. Louis Adjusted Monetary Base (AMBNS), Range 10yrs

Hyperinflation can set in and destroy the U.S. Dollar. With the debt spending and creation of money, the US Dollar is on track for destruction. Many people buy junk silver coins to use as a hedge against inflation in the event hyperinflation decimates the value in printed fiat currency.

Congressman Ron Paul discusses hyperinflation in this video.

Germany's post World War I Weimar Republic is a perfect example of monetary printing that got out of control, leading to hyperinflation.

Weimar Republic, Lady Using Money To Heat Home 1923

Weimar Republic, Money On Street

Weimar Republic, Wheelbarrow Of Money For 1 Loaf Of Bread

More recent examples of hyperinflation of currency are the Zimbabwe and Argentina inflation.

"History of the Collapse of Fiat Paper Currencies"

Silver value has a proven historical record dating thousands of years. Humans have treasured and adored the beautiful shiny metal silver and used it from everything from jewelry to coinage. Read more about silver's elequent history.

"History and Usage of Silver over the Millennia"

If you have decided to buy silver, then what form is best? You can buy junk silver coins (aka survival coins), silver rounds, and silver bullion bars. The junk silver coins give you added utility if they ever need to be used for bartering of food, other goods and services in the event the Dollar is not accepted. For this reason alone, many people prefer the junk 90 silver coins. Their purity is universally recognized at 90 percent pure silver as is guaranteed by the US Mint.

Click HERE for more suggested readings.